Bitcoin Surges Towards New All-Time Highs Factors Driving the Momentum Revealed

Bitcoin all-time highs At the start of this year in December we actually published our 2024 predictions and we said that Bitcoin would trade to new all-time highs above $80,000 a coin based on what we’re seeing in our ETF and these other ETFs

I think we have to revise that upwards it could be $100,000 it could be $200,000 it could be higher than that there’s simply this massive Supply demand Dynamic going on net new demand and a fixed Supply and actually a reduction in new Supply coming up in April with the happening sometimes investing is complex Bitcoin all-time highs

sometimes it’s easy with Bitcoin right now it’s just about Supply demand and there’s too much demand and not enough Supply there’s too much demand and not enough Supply as Bitcoin breaks 224 highs pushing up against all-time highs Wells Fargo and Bank of America’s Merrill are now pushing Bitcoin ETFs to their clients Morgan Stanley even coming out

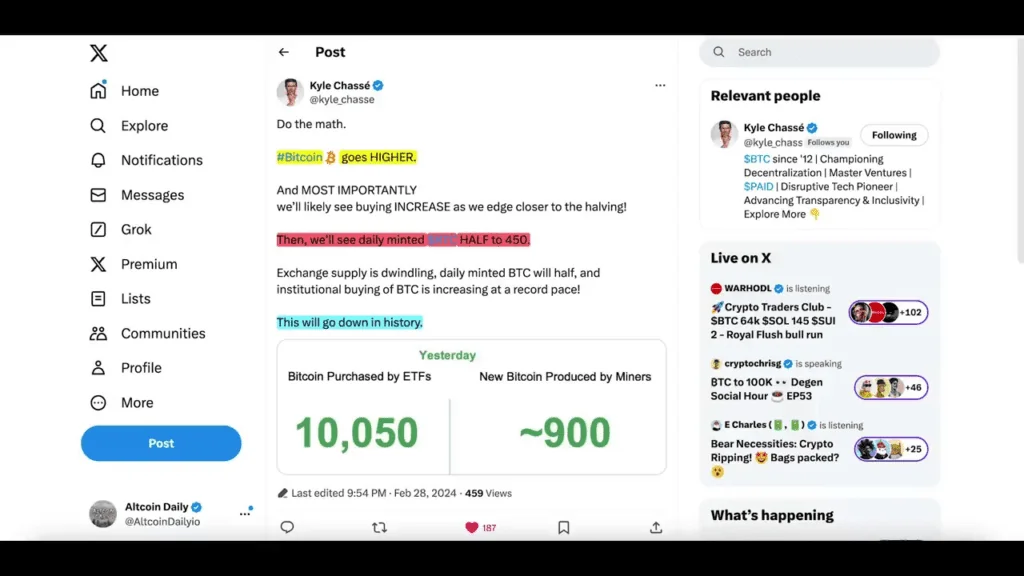

and saying that they’re considering offering Bitcoin ETFs understand that yesterday the Bitcoin ETFs took 10,000 Bitcoins off the market that same time frame only about 900 new Bitcoins were produced do the math Bitcoin goes much higher and most importantly will likely see buying increase as Bitcoin all-time highs

we edge closer to the halving then we’ll see the daily minted mined Bitcoin half from 900 to 450 exchange Supply is dwindling for 4 years ago there were 3 million Bitcoin on exchanges today there are only just 2 million Bitcoin on exchanges probably less than 4 years there’ll only be less than 1 million Bitcoin on exchanges because

the daily minted Bitcoin gets halved very soon and then four years later same thing and institutions keep buying at an increasing record Pace these ETFs are the most successful ETFs of all time this will go down in history take a look at the

data take a look at the metrics it is amazing what we’re seeing Bitcoin holders were right people who follow this channel were right the Bitcoin ETFs have now taken 5.57 billion in Just 2 weeks yesterday was a record day momentum is building 1 billion plus single days coming soon please don’t be like Greg please don’t be like Greg do not sell too early very reminiscent of gold Gold’s 1970 to 2009 price action right here looks strikingly similar to bitcoin’s chart Bitcoin all-time highs

over the last few years in a digital interconnected World Adoption happens much faster we’re now in the price Discovery phase for the next Global store of value Bitcoin historic times again I showed you this chart 6 months ago almost a year ago now we showed you this chart this is what happened when the gold spot ETFs hit

why couldn’t Bitcoin do this I think Bitcoin could do more than this because when there was a greater demand for gold they mined more gold they do that with every commodity they get more of the supply with Bitcoin they can’t real quick my friends cryptocurrency taxes do not have to be scary pay your taxes and Bitcoin all-time highs

you can get your taxes done in minutes through our partner coin Ledger use our link below to create a free account and get your crypto taxes done this is the Turbo Tax of crypto I’ve used this this is completely free to use you do not pay upfront

you only pay at the end when you want to download your tax report it’s so easy to use you get your crypto taxes done in minutes all you do is connect your wallet to coin Ledger coin Ledger automatically calculates your gains your losses your income in your home fiat currency for free so you track your gains your losses your income for free with this software if you use our link below you only pay at the end if and when you want to download your tax report again you must use our affiliate link to get all perks make sure you use our link below these guys are like the Turbo Tax of crypto Bitcoin all-time highs

they’re also trusted by regular Turbo Tax in that coin Ledger tax reports can be easily and simply imported into your Turbo Tax or Tax Act or whatever tax software you use I’ve used this service before coin Ledger crypto Tax Service works you will not stress over your crypto taxes

if you use this make sure and try this out for free you use this service it takes 5 minutes you’ll have such peace of mind when you’re done crypto taxes are easy with coin Ledger the world is finally starting to open its eyes as to how big of a deal the Bitcoin having is for Bitcoin and for Bitcoin holders Mike Mclone Bitcoin all-time highs

the senior commodity strategist at Bloomberg intelligence breaks down the halving can you just break down this whole halving thing I don’t understand how that’s okay to do that well hello um Alex it’s it’s in the code I have a son who’s a programmer I asked somebody says no it’s the code that it just buy code every four years the supply gets cut in half so right now all the miners in the world will only bit create 900 coins a day

and then as of the having to cut the 450 so it doesn’t have that high price cure that you really see affect most Commodities and why most Commodities are in bear markets with the exception of gold but it also on the supply side it’s just the way up and as our colleague Zeke false wrote out wrote number go up well that’s Bitcoin is designed to go up but now

it’s becoming an alternative currency on a global basis and the US is jumping in their fray and also a key thing you have to look at in from a macroeconomic standpoint is China’s kind of pushing back remember China is going for gold the largest gold buyer in the world and they were associated with this war and the US is just to prove ETFs and Bitcoin Bitcoin all-time highs

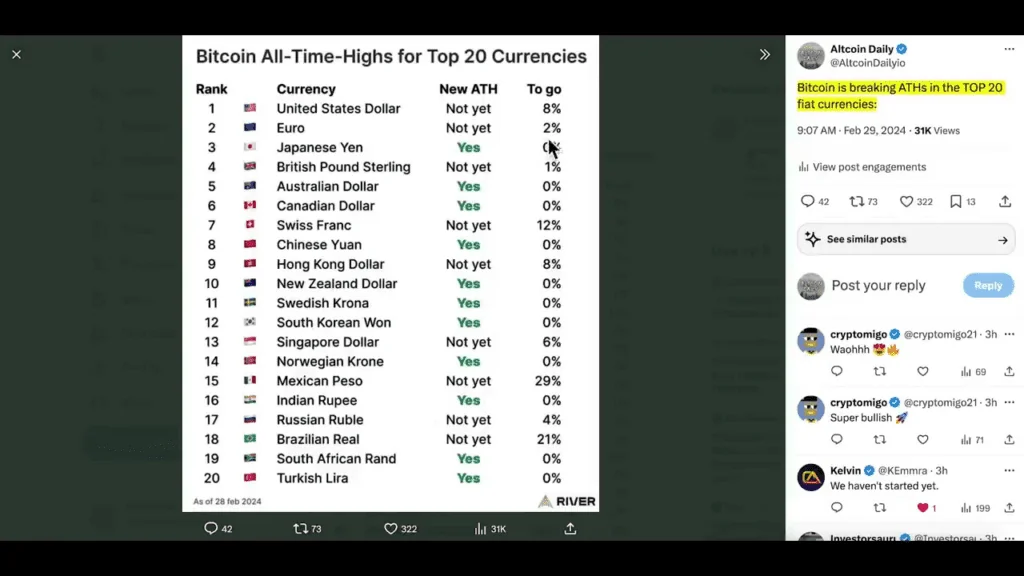

so you see where the world’s going towards intangible assets and Bitcoin is the most significant in crypto guys Bitcoin has already broken all-time highs in many of the top 20 currencies not the bottom 20 the top 20 Bitcoin is 8% away from breaking all-time highs versus the US dollar 2% away from breaking all-time highs versus the Euro 1% from the British pound 12% from the Swiss Franc Jason Lao the chief innovation officer at OKX and Chief Operating Officer

at OKCoin breaks this down you know it’s actually hit all-time highs in many many different currencies already I think the dollar the Euro Maybe the pound and the Hong Kong dollar are just a few where it has not already hit all-time highs earlier

this morning it crossed uh 9 million Japanese Yen and some of our our Japanese colleagues were were excited about that and so there’s a lot of euphoria out there right now for Bitcoin you can see what’s happening and what excites me even more is Bitcoin all-time highs

the fact that demand is ramping up Matt Hogan the CIO of Bitwise does a perfect job explaining where the demand has come from thus far and why the demand is going to ramp up and where the new demand is going to come from when you look at what’s been driving this price action on bitcoin matter

how much of this is retail investors investing directly in Bitcoin how much of it is the ETF how much of is institutions in the ETF absolutely it’s a great question we’re seeing enormous demand for the bitwise Bitcoin ETF and across all of these ETFs and the answer is it’s all of those categories you’re seeing retail investors come into these ETFs you’re seeing hedge funds you’re seeing raas or independent financial advisors I think there’s an even bigger wave coming in a few months as we start to see the major wirehouses turn on but this has been bitcoin’s IPO moment it’s in a new era of price Discovery and I think prices could go substantially higher from here let’s talk about where they could Bitcoin all-time highs

go in just a minute but I just want to go back to this idea of who you think is buying these ETFs meaning how much of this is retail versus institutions yeah absolutely you know when these ETFs first launch

they’re not turned on at the major wire houses at the major institutions so the initial demand out of the gate for any ETF including these is primarily retail and independent financial advisors and hedge funds so I think that’s the primary driver that’s

what we’re seeing but I’ll tell you after this meeting I’m getting on a plane to go talk to one of the largest institutional consultants in the US about this ETF so going to see that next wave of institutional Capital you did mention hedge funds which I will put in sort of an Institutional institutional or professional category in terms of this big move do you do Bitcoin all-time highs

it’s that money that’s pushed this or do you think it’s straight retail oh I think it’s I think it’s both I think it’s both it’s just new demand if you think about Bitcoin pre the ETFs there was only a small set of investors who could buy

it now almost everyone can buy it and the supply demand Dynamic is just off the hook there 30,000 ETF Bitcoin purchased by ETFs this week alone Bitcoin miners have only created less than 30,000 that’s what’s driving the price and it’s both hedge funds and Retail and that advisor Community hey guys it’s not just Bitcoin anymore Kathy Woods Ark invest just integrated chain link into

its Bitcoin ETF chain Link’s proof of reserves for its spot Bitcoin ETF injective after a 70-day reaccumulation breaking out obviously you guys know there’s a lot of different altcoins we like please check back on any of our videos from the last 6 months particularly if you want to find out about altcoins that I like cuz this is the cycle for altcoins guys Bitcoin all-time highs

the next big ethereum update will be this March EIP 4844 is an ethereum improvement proposal aiming to boost scalability then in May 2024 we’ll get the first spot ethereum ETF I’m bullish on the ethereum ecosystem especially when we see stuff like this Robin Hood is integrating an ethereum L2 arbitrum Robin Hood wallet users will be able to swap tokens on arbitrum based dexes the altcoin bull run is

just getting started subscribe to the channel join the team again I encourage you to look back on our videos from the past 3 to 6 months I mean think of it this way coinbase app isn’t even in the top 200 chart in the app store yet in 2017 and 2021 it hit the number one spot this run hasn’t even started we’re going to make so much money trading against

these regular type people according to this crypto Twitter Anon Aiden Ross and this other guy two of the biggest streamers getting Millions tens of millions of viewers every single time they stream this is them talking about crypto seems like we know a lot more than them dude eat is pumping right now what are you guys predictions Bitcoin all-time highs

with crypto would you guys think it’s going to PL like you guys think it’s going to Plateau like you don’t want it to plateau what yeah do we swap or we like what should we do I’m keeping Ethan you’re holding it I’m holding Ethan Ethan is going to be stable 100% what is eth going to 5 10K imagine it goes to $10,000 it won’t move that much I don’t think no it won’t it’s going to it’s going to peak at like four four that’s when you get out I’m swapping a lot half no not half okay I think it is stable though in general and I think even though if it plateaus it’ll if it go down it’ll go slowly me and Che were on the phone when eth went from like 3,000 to 1700 in one day

that sounds future is bright my friends join the altcoin daily team if you’re interested in making money in cryptocurrency Make sure you watch our Channel every day for a daily Edge it’s not Financial advice just info and opinion that being said guys we were right this is the kind of stuff we talked about 6 months ago a year ago two years ago and it’s finally coming to fruition great to be in crypto it’s depressing I I don’t want what has Bitcoin ever done for kind do you have are you ever bit own a Bitcoin phone.